The Illusion of ESG Readiness in India

At first glance, the ESG SaaS category in India appears as many investors describe it: early, fragmented, and underwhelming. Adoption remains limited, enforcement mechanisms are inconsistent, and even among listed companies, ESG filings are often boilerplate. Venture capital interest reflects this view — funding rounds remain small, and visible breakout winners are few.

But this top-level reading may conflate regulatory lag with structural unviability. When disaggregated by sector exposure, reporting complexity, and supply chain pressure, the signals begin to look less uniform. While broad-based adoption remains muted, there are early indications that ESG tooling may be gaining traction in select verticals — not because of regulatory mandates, but due to commercial incentives and buyer-side enforcement.

This blog lays out that view — not as a prediction, but as a working thesis grounded in sector-specific signals. It argues that ESG SaaS should not be evaluated as a horizontal category. Instead, adoption appears to follow vertical timing curves shaped by buyer expectations, export dependencies, and workflow design. Where those align, the conditions for software-led compliance may be forming — quietly, and unevenly.

Why Sector Pressure Doesn’t Always Mean SaaS Readiness

If ESG regulation and reporting pressure were the main drivers of SaaS adoption, then sectors like pharmaceuticals, chemicals, and automotive should be fertile ground. These industries face high emissions scrutiny, heavy export exposure, and increasing compliance obligations. But that’s not what the startup landscape reflects.

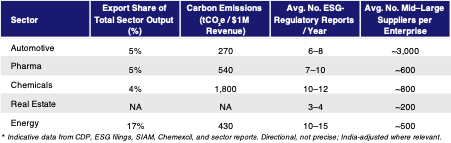

To understand this gap, we looked at four sector-level indicators:

-

Export share of output— signals buyer-led compliance pressure

- Emissions per unit revenue — proxy for environmental scrutiny

- Regulatory reporting load —

- Supplier depth — how distributed and hard-to-coordinate the ecosystem is

Each of these parameters reflects a different source of ESG pressure — from customer audits to government mandates to operational coordination. Combined, they help us assess whether a sector should be actively adopting compliance tooling.

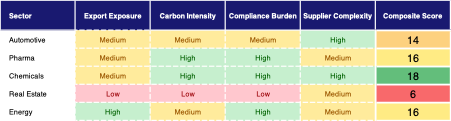

We then converted these metrics into a composite ESG pressure score — assigning each sector a relative High / Medium / Low based on available data. The resulting heatmap offers a quick view of where the ESG burden is likely most acute.

This visual shows a sector-wise heatmap of ESG pressure factors in India. It ranks Auto, Pharma, and Chemicals highest on composite readiness for ESG software adoption based on export exposure, emissions intensity, reporting load, and supply chain depth

Pharma, chemicals, and auto stand out with high scores across all four indicators. Real estate and energy, by contrast, appear lower on the ESG pressure scale.

And yet — pharma and chemicals have almost no visible startup presence. No scaled players are building vertically in these sectors. That contradiction is telling. Either the market isn’t ready, or something in our framework is missing.

That tension is what we explore next.

When ESG Pressure Doesn’t Translate to Adoption

Some sectors scored high across all four ESG pressure indicators — particularly pharma, chemicals, and automotive. These are the verticals where, on paper, ESG SaaS should thrive. But the market tells a different story.

We don’t see scaled startups building for pharma or chemical compliance — despite clear regulatory load, export exposure, and emissions footprint. That’s a contradiction we can’t ignore.

One explanation may be internalization: many large firms in these sectors already manage ESG through in-house systems or consultants. In family-run or legacy businesses, compliance is often offline, episodic, or disconnected from core digital workflows. This makes software integration difficult — even when external pressure exists.

Automotive, by contrast, shows early signs of traction. Tier-1 suppliers face mounting pressure from OEMs — with buyer-led audits and ESG-linked financing beginning to shape adoption. The shift is narrow, but visible.

This isn’t a sweeping endorsement of any one sector — but it does suggest that pressure alone doesn’t drive SaaS readiness. Internal workflow ownership, buyer-side enforcement, and the nature of existing systems all play a role.

Why Software Often Misses the ESG Workflow

Part of the problem lies in how most ESG tools are designed. They assume compliance is a discrete, standardized task. In practice, it isn’t.

ESG data often spans legal, procurement, finance, and sustainability teams. Ownership is fragmented. Reporting formats shift based on geography, buyer, or investor — for example, EU REACH filings for pharma look nothing like CDP disclosures for auto suppliers. This heterogeneity makes repeatable product workflows difficult to build.

That’s why consultants remain dominant. In mid-market or legacy firms, they’re the system of record — assembling, interpreting, and filing reports. When software is used, it’s often just the delivery layer for consultant output, not a core business tool. That weakens product stickiness and limits scale.

The issue isn’t lack of pressure. It’s lack of standardization and tooling alignment.

What’s emerging, though, is a clue: ESG SaaS may not scale horizontally. It needs to anchor to very specific workflows, in very specific sectors — where external triggers are forcing firms to act and internal ownership is strong enough to drive software adoption.

The Data That Changed Our View

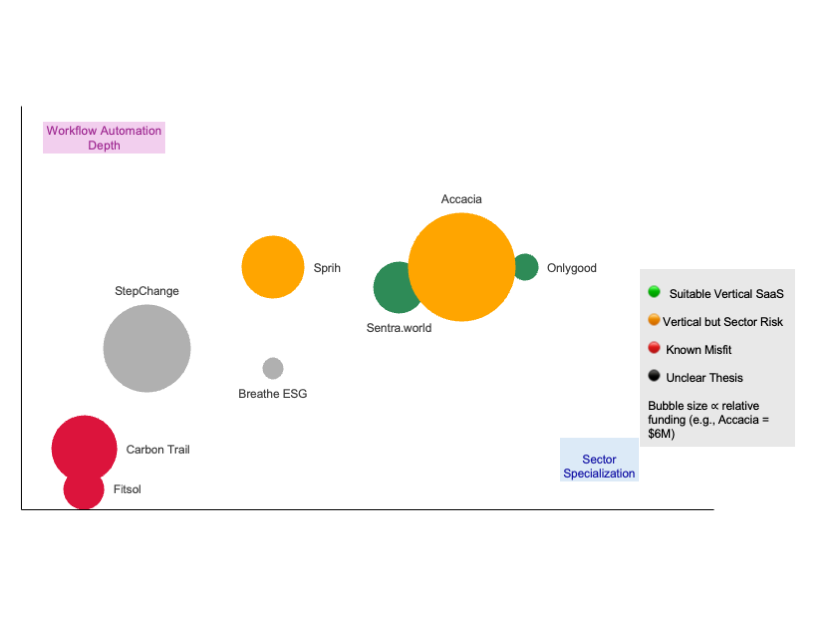

To identify where ESG SaaS adoption might be gaining early traction, we mapped Indian startups in the space across two dimensions:

- Y-axis: Workflow Automation Depth

- X-axis: Sector Specialization

…We scaled each startup’s bubble by total funding and color-coded it based on the sector-fit heatmap introduced earlier. What emerged was telling.

A cluster of startups — particularly in automotive — sits in the upper-right quadrant. These players show moderate vertical depth and some traction, suggesting early signs of alignment between buyer pressure, internal workflows, and product fit. They are not scaled, and none have become category-defining — but relative to other sectors, they are ahead.

In contrast, pharma and chemicals, which score high on all four sector-fit metrics, are nearly absent from the startup landscape. This disconnect is not a minor anomaly — it is a core tension. Either the market isn’t ready, or our model is missing critical constraints: entrenched consultant relationships, legacy IT systems, or resistance to external platforms may be part of the explanation.

This mismatch between our framework and startup activity doesn’t invalidate the model — but it does caution against linear extrapolation. Early signals may point toward auto as the more feasible starting point — a sector where Tier-1 suppliers, OEM audits, and export scrutiny are creating conditions for ESG tooling to stick.

A Thesis Reframed: ESG SaaS Must Go Vertical, Not Broad

What began as a top-down exploration of ESG pressure ended as a bottom-up case for vertical specificity. The clearest signal wasn’t emissions or regulation — it was where ESG compliance has become commercially non-negotiable and where workflows are ready to absorb software.

In this lens, ESG SaaS stops looking like a horizontal category. The sectors where adoption seems most feasible — auto Tier-1, select industrial nodes, or export-linked clusters — share two traits:

- A buyer, auditor, or financing partner forcing action

- A repeatable internal process where software can embed

That’s not true everywhere. In many high-pressure sectors, compliance is episodic, diffused across teams, or outsourced to consultants — reducing the case for SaaS, even if the pressure is real.

So we’ve reframed the thesis. The right question is no longer “Who needs ESG tooling the most?”, but rather:

“Where is ESG SaaS most likely to stick — and scale — in India?”

What This Means for Investors

- Tone adjustment: Removed phrases implying Accrezeo is “backing” or “not backing” — kept focus on VC lens, not firm stance.

- Added clarity on risk-reward: Articulated the attractive entry point due to muted capital and early-stage concentration.

- Avoided repetition: Did not rehash sector-fit logic already explained; focused on investor incentives and strategic timing.

- SEO refinements: Phrases like “ESG SaaS India investment”, “early-stage ESG startups”, “vertical SaaS distribution moat” are subtly embedded to improve discoverability without distorting tone.

Like This Analysis?

We publish thesis-driven, sector-specific insights on markets that are often written off — until the signals shift.

Explore more from our series:

• Fast Fashion x Q-Commerce: Why Speed Isn’t Strategy

• Ayurveda White Space: Everyone Believes in Ayurveda. So Why Is the Mass Market Still Unsolved?

• LegalTech: The Courtroom Comes Too Late — Infra Starts Earlier

Building in a Complex Market?

At Accrezeo, we work closely with early-stage founders — especially in sectors where signal exists but narrative clarity is missing. If you’re navigating regulatory grey zones, legacy inertia, or complex buyer workflows, this is the kind of layered thinking we bring to the fundraise table.

This ESG SaaS analysis is one example — and part of a broader thesis on undercapitalized verticals with long-term breakout potential.

Let’s connect if you’re building something real.

→ Reach out at rsutaria@accrezeo.com