Everyone’s Consolidating — But That’s Not the Whole Story

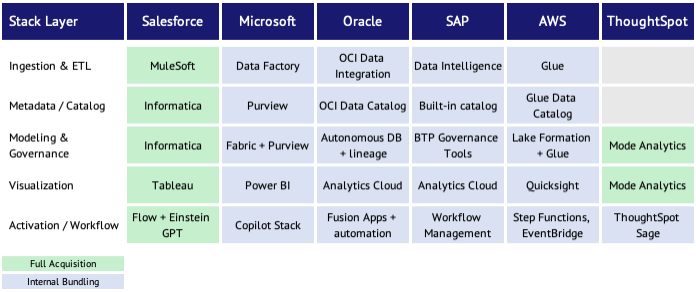

Across enterprise data infrastructure, the consolidation wave is very real. Over the past two years, nearly every major platform player has tightened its grip on the stack. Salesforce’s $8B acquisition of Informatica is only the latest in a series of moves. Microsoft has bundled Synapse, Power BI, and Data Factory into Fabric. Oracle has expanded into observability and automation. SAP is layering vertical orchestration tools on top of core ERP. AWS continues to absorb data ingestion, cataloging, and governance into its ecosystem.

These aren’t feature grabs. They’re full-stack plays — efforts to minimize integration debt and position as “AI-ready” platforms. The game is no longer about best-in-class tooling. It’s about coherence: where ingestion, transformation, governance, and activation all happen in a tightly coupled loop.

But coherence alone isn’t enough. While owning more of the stack reduces breakpoints, it also creates new challenges — especially around adaptability, domain fit, and long-term extensibility. The more infrastructure is absorbed under one roof, the more vendors standardize around internal abstractions. That improves stability, but often at the cost of responsiveness.

In our view, consolidation is no longer a signal of strength. It’s a requirement — the baseline needed to play in what’s coming next. The question isn’t whether the stack is being absorbed. It’s what kind of systems will still matter once it is.

Why the Informatica Deal Made Us Re-read Our Thesis

The Salesforce–Informatica acquisition isn’t just another headline. It’s a reframing moment. For a long time, M&A in the enterprise AI space focused on front-end tools — dashboard extensions, chatbot copilots, summarization layers. Informatica doesn’t belong in that category. It lives deeper in the stack: ingestion, metadata, governance. It shapes how enterprise data is cleaned, tracked, and made trustworthy — not just how it’s displayed.

The choice to spend $8 billion in cash signals intent. Salesforce didn’t just want to surface insights faster. It wanted control over the base layer those insights depend on. Informatica gives it that — pipelines, lineage, access controls, and schema-level fidelity that underpins every decision logic flow.

That decision forced us to revisit a key line in our own thesis: value was shifting from reporting to action. We still believe that. But what the Informatica deal highlights is that action without trust isn’t durable. No matter how intelligent a system appears, if its inputs aren’t traceable, verifiable, or governable — it won’t scale in real environments.

So we’re not walking back our thesis. We’re sharpening it. Agentic platforms — those that reason and act — still represent the next layer. But for them to operate reliably, they need more than intelligence. They need audited substrates, governed flows, and integration into the real-world messiness of enterprise systems. That’s what this deal made obvious.

What Agentic Infrastructure Actually Demands

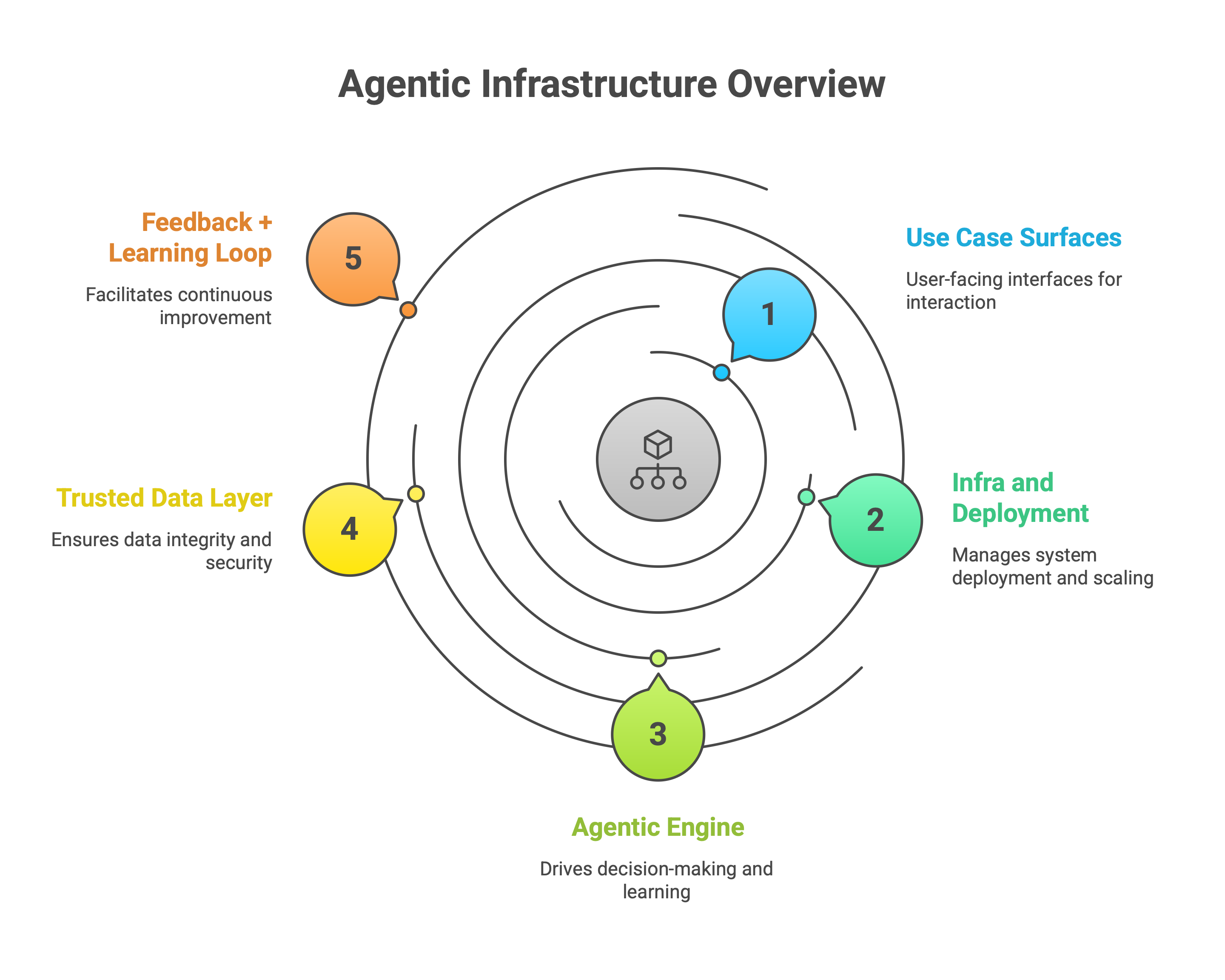

Agentic systems — those that reason, decide, and act — don’t just add another interface to the stack. They change what the stack needs. Traditional analytics platforms focused on surfacing insights for human review. But agentic platforms are expected to operate on those insights autonomously. That raises the bar. It’s no longer enough for data to be accessible or well-modeled. It must be governed, interpretable, and reliable in motion — because the cost of a misfire in production is far higher than a dashboard error.

This is where most “AI-ready” claims fall apart. What’s marketed today as agentic is often just a GenAI wrapper — it can summarize, maybe suggest, but it doesn’t monitor, decide, or act unless prompted. And when it does act, the execution path is fragile. There’s no lineage, no validation, no control over downstream effects.

True agentic infrastructure demands a different foundation:

- Data pipelines with lineage.

- Governance models that define when action is safe.

- Event-triggered execution architectures.

- Boundaries between suggestions and decisions.

It also reframes what doesn’t matter. Flashy copilots, drag-and-drop AI workflows, or auto-generated insights don’t move the needle unless the underlying substrate is sound. What matters is whether the system can operate — repeatedly and safely — in live environments.

When we revisited our thesis, this part became sharper. The winners in agentic infrastructure won’t be the smartest tools. They’ll be the safest systems. Trust, not just intelligence, is the moat.

Where the Incumbents Fall Short — and Will Likely Continue To

Owning the full stack doesn’t mean you’ve solved it. Most large vendors now offer end-to-end suites — ingestion, modeling, visualization, and even activation. But stitching those components into a coherent system still falls short. The problem isn’t availability. It’s integration.

Take Microsoft. It offers Power BI, Synapse, Fabric, and Copilot — but many of these were developed independently and only recently bundled under Fabric. Enterprise teams still spend time aligning schemas, syncing permissions, and managing orchestration layers manually. That overhead slows down execution, especially in environments where speed and precision are tied to operational value.

SAP is another example. It’s added Joule and expanded its vertical logic, but the foundation is still built for predictability and compliance — not iteration. It works well in regulated flows but struggles in dynamic, signal-rich contexts where automation must evolve on the fly.

Salesforce, even after acquiring Tableau, MuleSoft, Slack, and now Informatica, still doesn’t behave like a fully unified platform. Each component has value. But for users trying to go from insight to action, the transitions between layers often require external configuration or custom middleware. The stack exists — but it doesn’t always flow.

This doesn’t mean these companies are failing. They’ve built powerful systems. But they weren’t designed to act as one from the start. And that creates opportunity: not for infrastructure replacements, but for coherence layers — tools that make these systems behave like an orchestrated whole. That’s where we see room for new players.

What’s Actually Working in the Wild

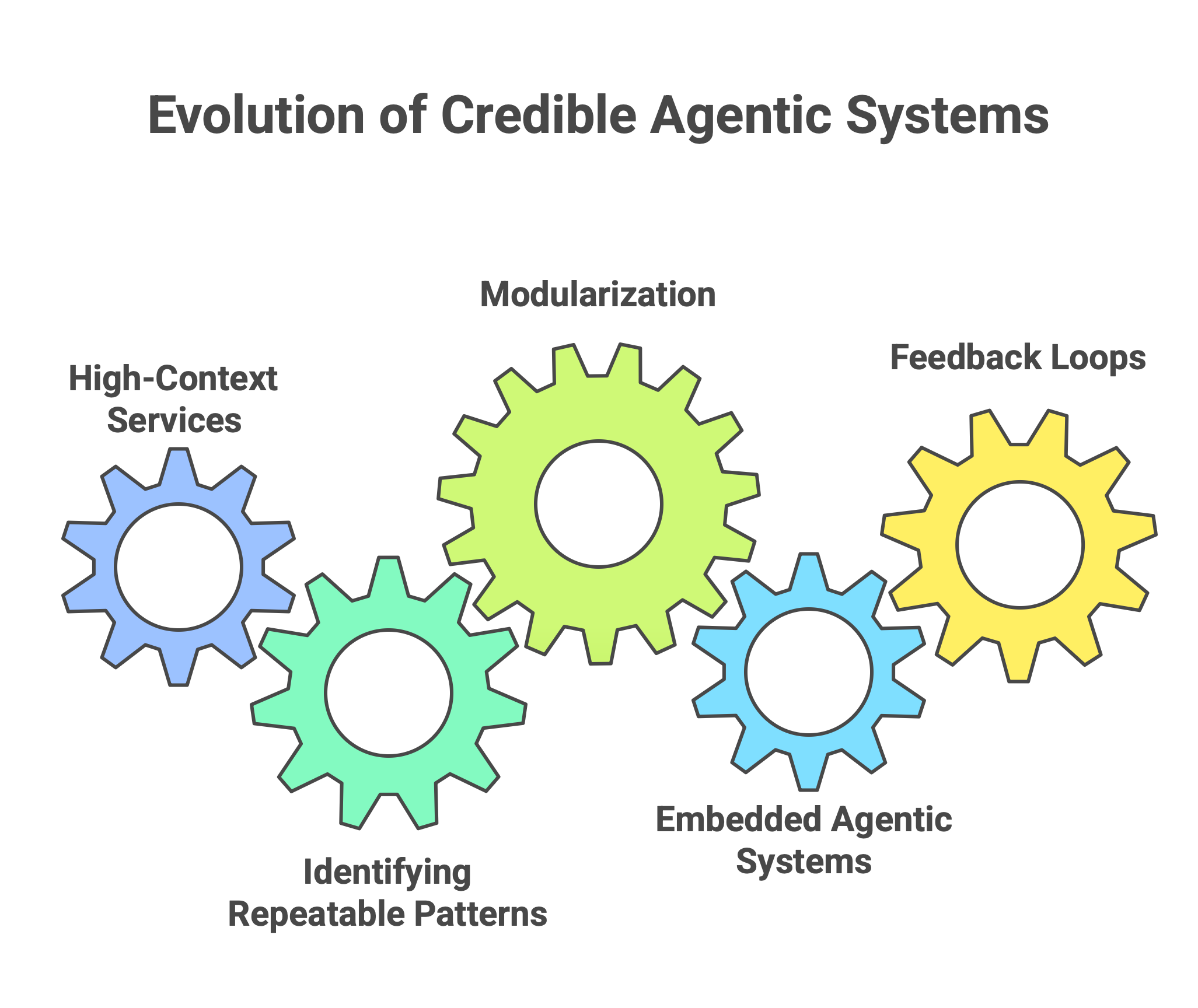

Amid the noise around GenAI platforms and agentic automation, the most credible examples don’t come from all-in-one systems. They come from modular tools that quietly slot into real enterprise flows — not as centerpieces, but as components that reduce friction.

One common pattern is trigger-driven workflows — systems that respond to signals and act, without needing dashboards or human prompts. Think lead behavior trackers that auto-adjust campaigns, or procurement monitors that flag anomalies without daily check-ins. These tools don’t demand visibility. They create value by acting in the background.

Another pattern is vertical-first logic layers — especially in sectors like insurance or finance. For example, claims triage systems that pre-approve payouts or escalate exceptions, based on structured rules and historical learning. These systems aren’t flashy. But they fit the process. And in enterprise settings, that’s often what matters more than novelty.

A third model is lightweight modular intelligence — tools that embed into CRMs, ERPs, or data warehouses to suggest actions, validate inputs, or improve flows. They don’t control the system. They help it behave more intelligently, without demanding that users change how they work.

What ties these examples together isn’t tech trend alignment — it’s process-level fit:

- They act on signals, not just data.

- They reduce execution latency.

- They don’t pretend to be platforms — they behave like building blocks.

These systems aren’t perfect. But they point to a shape of what early agentic systems might look like: quiet, embedded, and useful from day one — not because they “wow” users, but because they work with what’s already there.

Who’s Likely to Win — and Who Becomes Irrelevant

stack consolidation accelerates, the playing field narrows — especially in infrastructure. The major platforms have already claimed the defensible zones: ingestion, governance, identity, cataloging. Competing directly in those layers now is capital-intensive and strategically brittle.

But the opportunity hasn’t disappeared. It’s shifted. Instead of asking “what’s left to build,” the better question is “what’s still brittle enough to improve?”

Right now, the most fragile zone is at the top of the stack — interfaces and wrappers. Many GenAI startups operate here: copilots, dashboards, or conversational overlays. These often look differentiated in demos, but struggle to sustain value. Why? Because they don’t control their data, don’t integrate into backend execution, and don’t improve meaningfully over time. They may vary in output, but their core logic remains static.

In contrast, systems that seem more durable tend to:

- Work across infra rather than trying to rebuild it.

- Adapt through feedback loops, improving with each deployment.

- Remain light and pluggable, not tied to one ecosystem.

- Take responsibility for execution — not just recommendations.

The future doesn’t belong to any one architecture. But a pattern is emerging: the systems that survive consolidation are those that can act, learn, and stay useful — even as the stack around them changes.

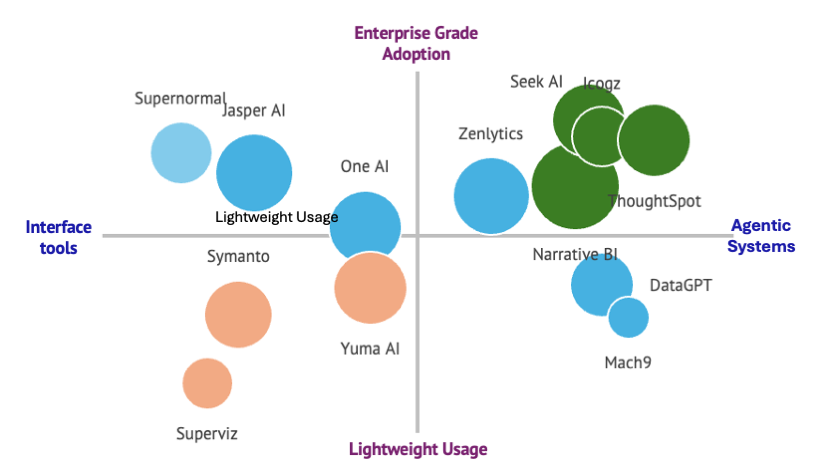

Green= Agentic systems: tools that enable decision execution and improve over time

Blue= Interface-first tools: GenAI wrappers focused on insights or summarization

Gray= Infra-anchored incumbents (not plotted): players like Salesforce already controlling base layers

Orange= Workflow plugins: modular add-ons with limited autonomy or data control

: For Founders — Avoiding the Platform Trap

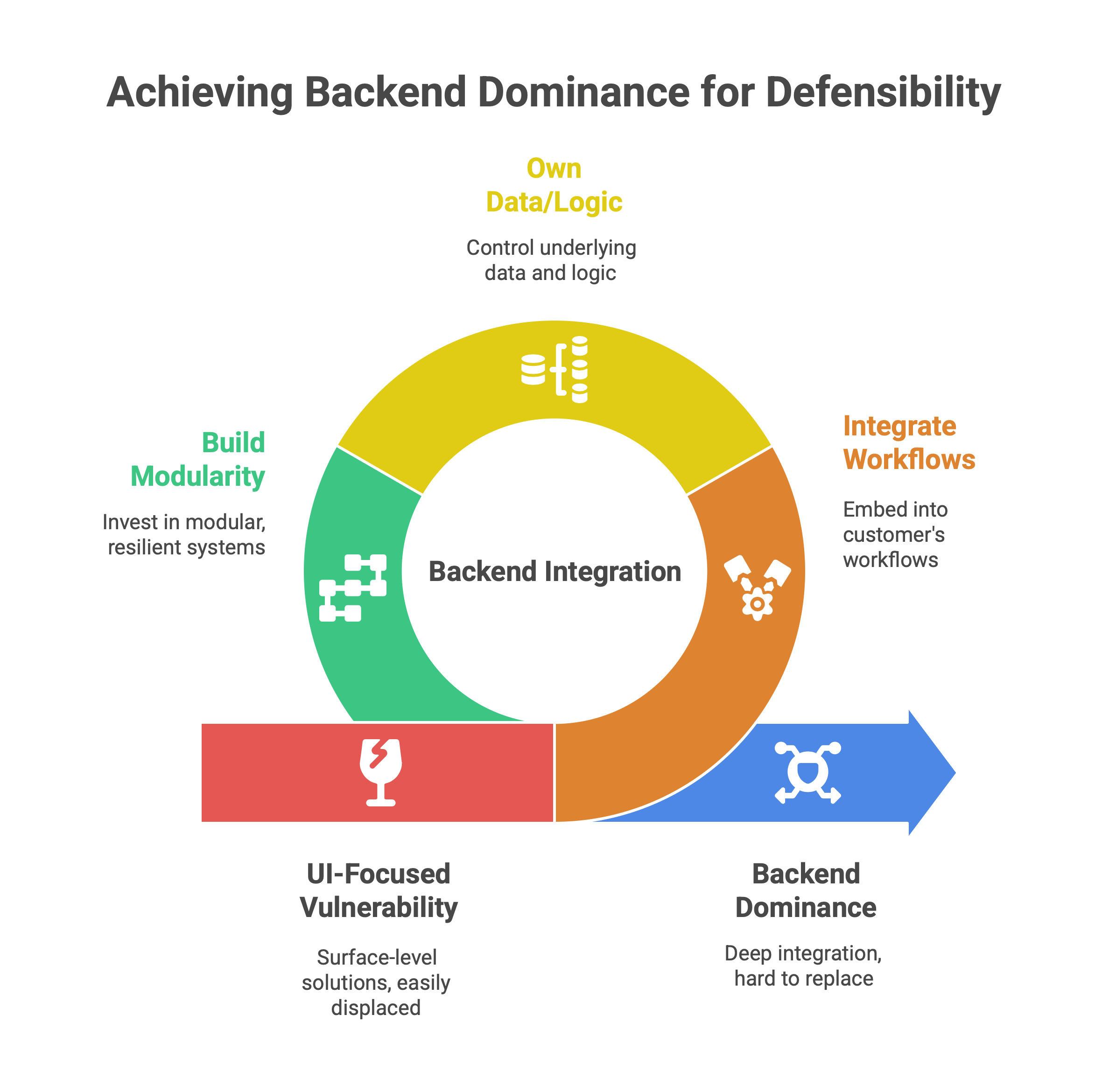

One of the clearest signals from the agentic shift is where value doesn’t last: at the surface. Interfaces that once felt differentiated — because they looked new — lose relevance quickly when platforms integrate beneath them. What matters more is where systems are hard to replace. And that’s almost always below the surface.

We’ve seen this play out in India. Razorpay began with a sleek checkout layer, but scaled by embedding into deeper financial ops — from payouts to compliance. In retail tech, GoFrugal and CaptainBiz evolved from POS tools to ERP backbones by locking into daily workflows. In lending, Perfios didn’t scale on UX polish. It scaled by owning risk-layer data extraction and underwriting rails.

The same dynamics may apply to agentic AI. Today’s attention is on copilots, assistants, and overlays. But most of these tools rely on data they don’t control and workflows they don’t own. As the underlying platforms consolidate — and start offering their own automation layers — these wrappers risk becoming interchangeable.

That doesn’t mean founders should pivot to infra. But it does mean they need to plan for the moment when a larger player integrates under them. If your tool is surface-only, can it survive as a module? Can it flex across ecosystems? Does it improve with use?

Founders who bake in flexibility — through modular architecture, system-agnostic connectors, and learning loops — may not get the fastest demos. But they might build the longest-lasting companies

For VCs — What the Next Layer Might Look Like

If the last cycle funded visibility — tools that claimed intelligence — the next one may need to fund durability. And durability in enterprise AI doesn’t usually look impressive at seed. It looks like quiet integration, signal-based execution, and the willingness to be infrastructure without looking like it.

The Informatica acquisition was a reminder: the platforms with the strongest moats still sit on trusted substrate. But those layers are now spoken for. What’s emerging is a new kind of investable system — not infra competitors, but infra enablers. Tools that don’t own the stack, but help it act more intelligently.

These aren’t wrappers. They’re connective tissue:

- Systems that route execution, not just surface options.

- Tools that improve through deployment, not just training.

- Products that plug in wherever the enterprise stack already exists — and get better each time they’re used.

The upside here isn’t flash. It’s staying power. Especially in markets where trust, repeatability, and long lifecycle relevance matter more than polish.

Agentic platforms that embody these traits — modular, outcome-driven, and ecosystem-agnostic — may not raise flashy rounds. But they’re architecturally aligned with what real enterprise systems demand as consolidation deepens.

In our view, the filter has shifted. It’s no longer “does this demo well?” It’s “does this survive when the infra beneath it changes?”

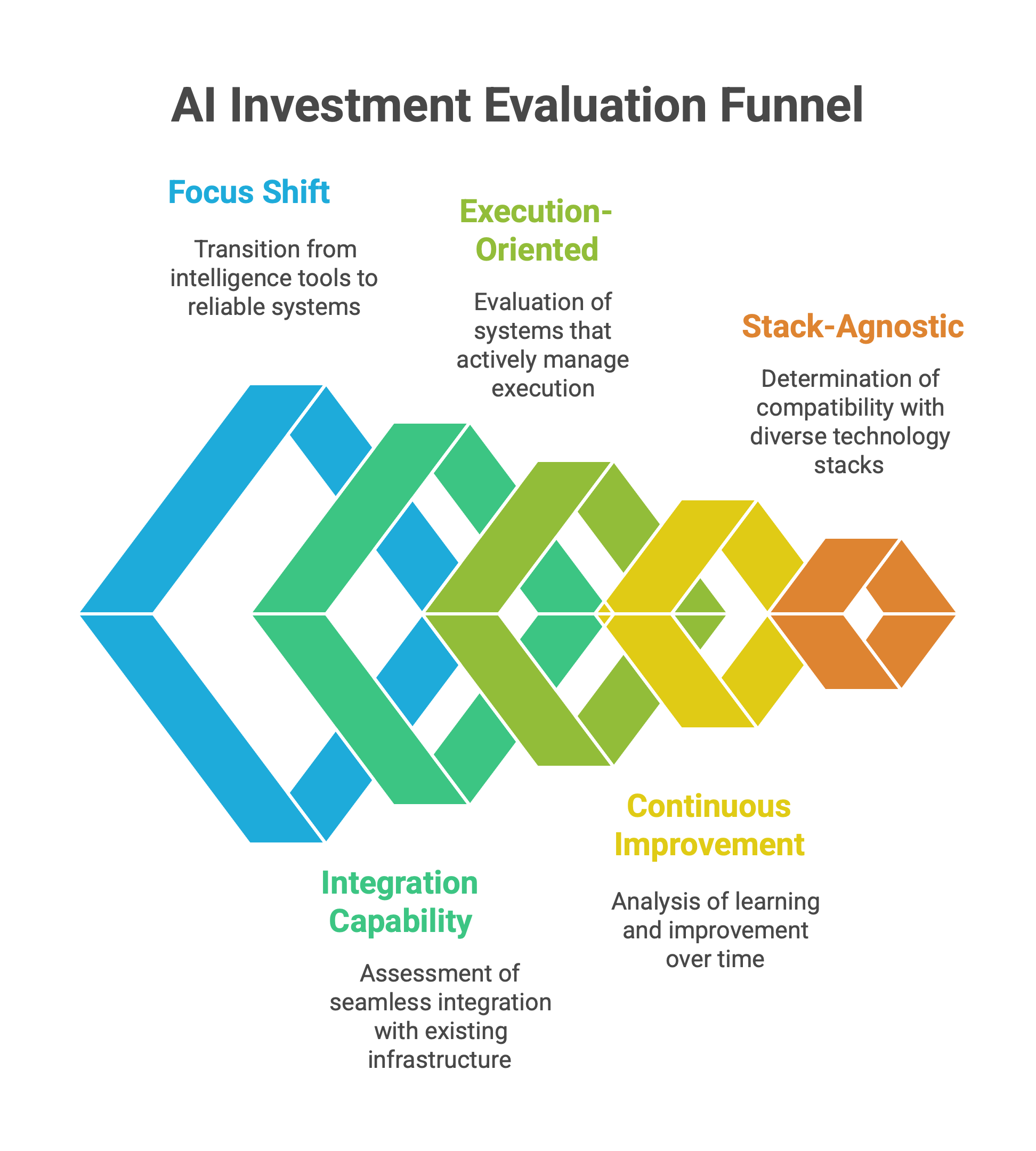

This funnel visual outlines the six-layer framework investors can use to evaluate agentic AI and enterprise automation systems. Each stage of the funnel reflects a shift away from surface-level intelligence toward durable infrastructure:

- Focus Shift – From flashy intelligence tools to reliable, execution-ready systems

- Integration Capability – Ability to plug into existing enterprise stacks seamlessly

- Execution-Oriented – Prioritization of tools that directly manage and automate decisions

- Continuous Improvement – Platforms that learn and evolve with use

- Stack-Agnostic – Systems that can operate across diverse technology environments

The structure reflects how modern AI investment theses are changing — favoring adaptability, learning, and plug-and-play resilience over interface polish or demo performance.

Like This Analysis?

We publish thesis-driven insights on markets where narrative clarity often lags signal. Read more from this series:

- Fast Fashion x Q-Commerce: Why Speed Isn’t Strategy

- Ayurveda White Space: Everyone Believes in Ayurveda. So Why Is the Mass Market Still Unsolved?

- LegalTech: The Courtroom Comes Too Late — Infra Starts Earlier

Building in a Complex Market?

We work closely with early-stage founders navigating regulatory grey zones, multi-tool workflows, and infra-heavy sectors. If this thesis resonates, let’s connect.

Also referenced in this piece: Why Agentic AI Changes the Game for GenAI BI Plays — the original articulation of our substrate-first enterprise thesis.