The Legal Infra Moment: What’s Changed in India

LegalTech in India often feels like a solved story — from marketplaces like LawRato to AI research tools like Jhana.ai and contract platforms like SpotDraft. Yet despite the category’s visible sprawl, infrastructure-style plays remain rare. Most LegalTech startups either wrap existing workflows in prettier interfaces or chase episodic use cases with little compounding leverage.

But in our view, something’s shifted.

Three signals are converging:

- Structural enablers like RERA have turned legal compliance into a recurring, rules-bound function in real estate.

- Process fatigue among mid-sized developers and legal consultants has created a demand for standardization, not just staffing.

- AI maturity has made it possible to embed intelligence into logic-heavy workflows — not just surface-level summaries.

LegalTech infrastructure has long been held back by the unpredictability of Indian legal systems. But in domains like real estate, where legal action is not optional — it’s operational — that unpredictability shrinks. And that’s the opportunity.

This blog isn’t about yet another legal tech tool. It’s about a system-level wedge — one that starts not with courtrooms, but with construction projects. Not with strategy, but with paperwork. Not with disruption, but with execution.

Why Real Estate Compliance Is the Hidden Layer of Legal Infra

Legal infrastructure doesn’t start with litigation. It starts where regulation meets repetition. And in India, nowhere is that intersection clearer than in real estate compliance.

Unlike legal advisory or courtroom workflows, real estate legal work is not episodic — it’s systemic. Every new project triggers a standardized set of filings: title clearance, encumbrance certificates, RERA registration, agreement drafting, quarterly disclosures. The work is high-volume, high-stakes, and legally mandated.

But here’s the kicker: it’s still manually executed.

State-level portals vary wildly in UX, formatting logic, and template requirements. There are no APIs. Consultants still prepare filings offline and reformat documents by hand. Even in tech-forward states like Maharashtra, most filings happen through human labor, not structured workflows.

And that’s why this space matters.

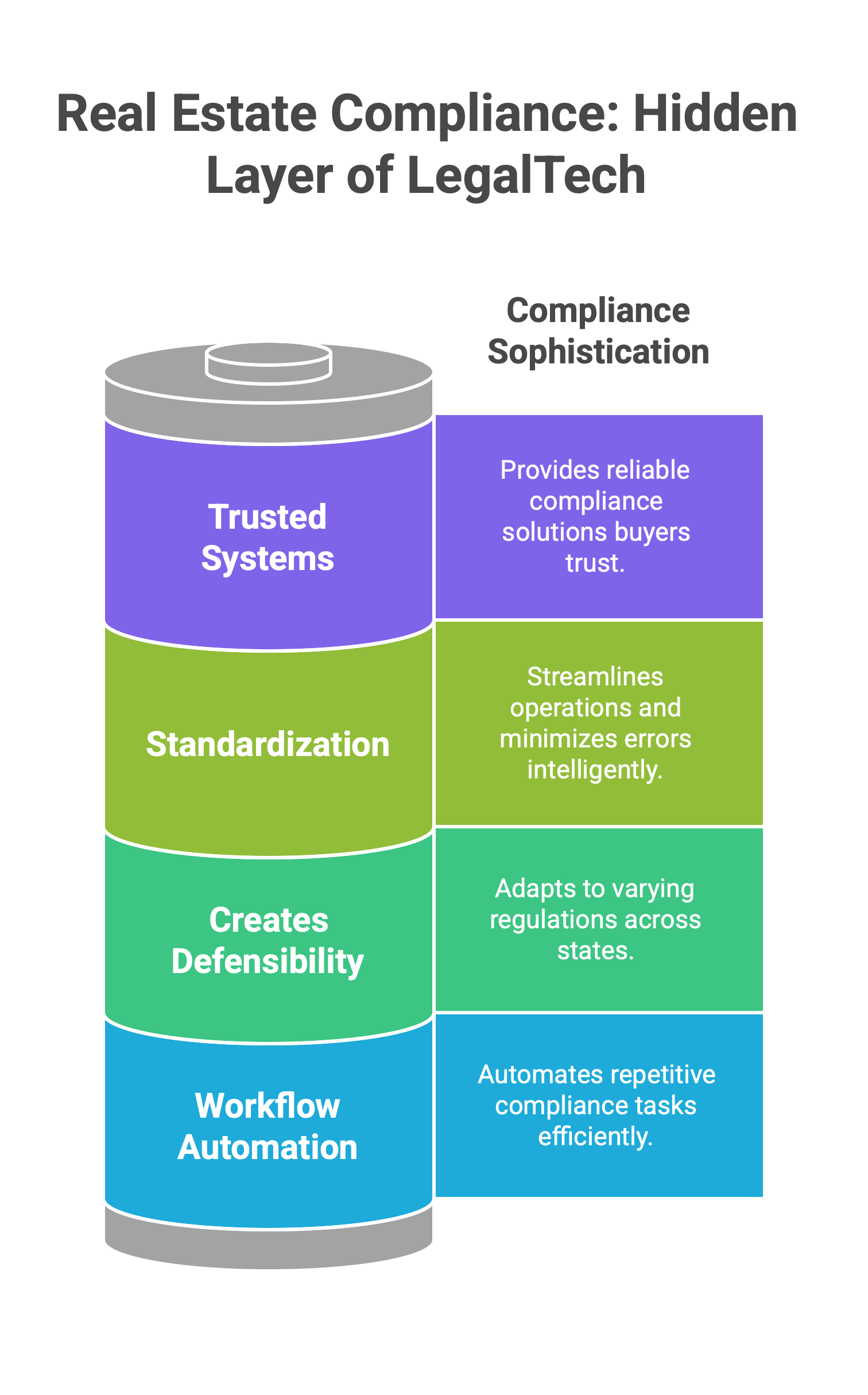

Real estate compliance is:

- Trusted— Buyers demand legal clarity, and RERA enforcement is non-negotiable.

- Standardized— Rules are codified, predictable, and repeatable.

- Defensible— State-wise fragmentation makes infra hard to replicate.

- Automatable— The same tasks repeat across hundreds of projects.

This is not a back-office problem. It’s the front door to building India’s legal infra layer — one project filing at a time.

Why Real Estate Is the Right Entry Point for LegalTech Infra

Spot the White Space — Adoption Is Rising, Infra Is Missing

Most Indian LegalTech startups remain anchored to narrow functions. CLM dominates funding. Research tools show episodic usage. Dispute resolution platforms chase fragmentation. But very few own workflows end-to-end — and even fewer are building the infrastructure layer that can generalize beyond one legal event.

That’s what the data shows too.

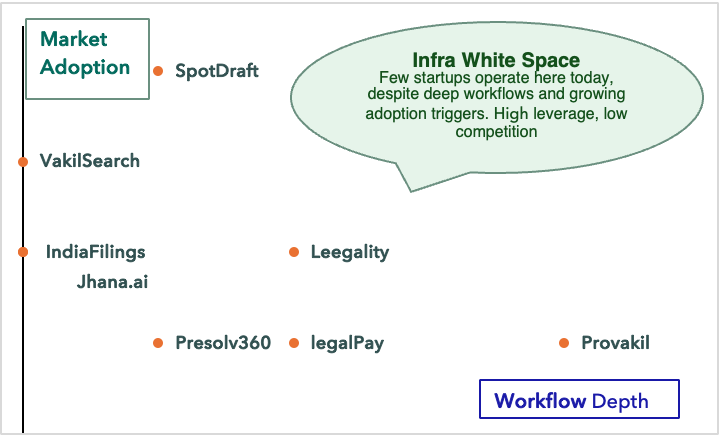

We mapped top LegalTech startups across two dimensions:

Workflow Depth (how embedded and repeatable their product is) and Adoption Maturity (how widely their use case has scaled in India). The result was clear — the top-right quadrant, where infrastructure plays usually reside, is nearly empty.

This isn’t a design flaw. It’s a market gap.

Startups like SpotDraft (CLM) and VakilSearch (practice tools) have built category-specific depth, but remain functionally siloed. Others like Jhana.ai or JurisChat add AI augmentation, but sit atop shallow workflows. And yet, real estate compliance — with its combination of rule-bound repetition, jurisdictional variance, and structured documents — sits squarely in the white space.

LegalTech Landscape: Market Adoption vs Workflow Depth

This is where the infra stack begins. Not with another marketplace or research tool — but with workflows that are boring, repeatable, and non-optional.

Can They Build Infra? — Assessing Platform Depth and Infra-Readiness

Many LegalTech startups in India have achieved product-market fit within narrow workflows — CLM for enterprise contracts, document automation for filings, ODR for low-stakes disputes. But few have demonstrated the capability or intent to build infrastructure-layer systems. Why?

Infra-building isn’t about features. It’s about owning workflows, accessing structured data, and handling regulatory variability — all at once. Most existing startups are optimized for linear use cases: send contract →get signature, or file case → resolve dispute. These are valuable, but they don’t lend themselves to compounding data loops or deep product lock-in.

We evaluated six representative startups across five criteria:

current focus, workflow ownership, data structuring, jurisdictional reach, and infra entry readiness. Only one (Provakil) shows signals of being infra-aligned today. Others — like Leegality and Jhana.ai — may evolve into infra plays, but aren’t built for that yet.

🛈 This table is not a forecast. It’s a reflection of today’s product focus and organizational posture. Startups may pivot, expand, or partner. But infra-readiness isn’t accidental — it’s architectural.

Infra Readiness of Key LegalTech Startups

Where the Capital Went — And Where It Didn’t

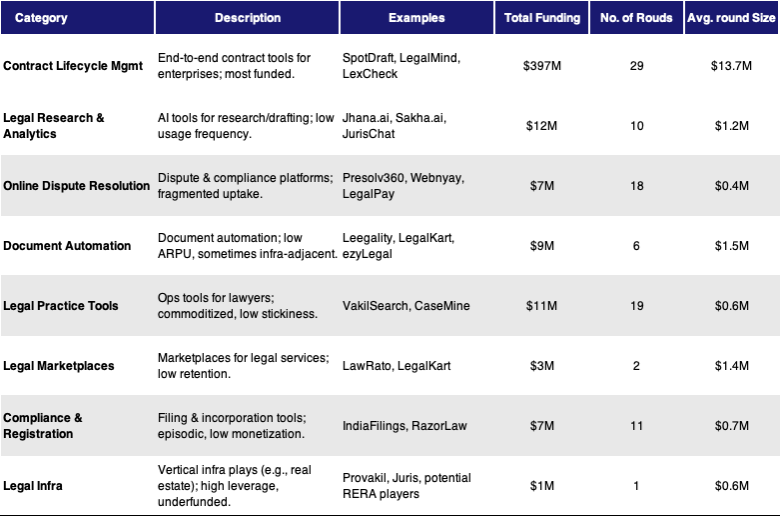

Over the past five years, LegalTech in India has raised ~$450M across ~100 rounds. But the capital wasn’t evenly spread — it followed familiarity.

~85% of the total funding went to Contract Lifecycle Management (CLM) startups. These plays — e.g., SpotDraft, LegalMind, LexCheck — offered enterprise SaaS models, plugged into procurement workflows, and avoided regulatory complexity. That made them fundable. But it also made the space crowded and vertically shallow.

By contrast, infra-layer opportunities like real estate legal automation have received <0.5% of total funding. Not because the use case is weak, but because it requires:

• Deeper workflow integration

• Domain-specific knowledge

• Non-linear monetization logic

This capital imbalance reflects an attention gap, not just a risk discount.

Funding Concentration Across LegalTech Categories

Source: Tracxn LegalTech Report, Jan 2025

Note: We’ve standardized Tracxn’s 40+ subcategories into 8 investment-relevant clusters for consistency.

We’re Not Betting on a Vertical — We’re Betting on Workflow Control

This isn’t about real estate as a sector. It’s about where the legal system’s friction is both concentrated and solvable.

Infra in LegalTech doesn’t start where the law is complex — it starts where the law is repetitive, regulated, and consequences are real. Real estate compliance happens to be the most tractable starting point.

But if infra succeeds here, it won’t stop here. The same product layer — once trained on filings, title checks, clause variation, and tribunal outcomes — can move horizontally into:

- Land ownership records

- Infrastructure contract workflows

- Tax compliance ecosystems

- Lending and underwriting data layers

Each of these is a higher-ARPU, legally entangled system — with the same characteristics: repetition, rules, and risk.

We’re not pitching a product. We’re making a case that the legal backend of Indian real estate is where infrastructure starts — not ends.

Like This Analysis?

We publish contrarian, research-driven insights on markets that are often overlooked — until they’re not.

Read some of our latest work:Fast Fashion x Q-Commerce: Why Speed Isn’t StrategyAyurveda White Space : Everyone Believes in Ayurveda. So Why Is the Mass Market Still Unsolved?

Building in a Complex Market?

We help startups fundraise with conviction — built on the kind of layered, data-backed thinking you see here.

If you’re solving a real problem and navigating a messy sector, we’d love to hear from you.

→ Reach out at rsutaria@accrezeo.com