If You Think Every Gen-AI BI Play Is Just Another Wrapper — This Might Change Your Mind

A closer look at the architecture shift happening beneath the buzzwordsAnother AI

Dashboard?

Every VC has seen this pitch: “We’re building an AI-powered business intelligence platform.” There’s always a slick demo, a chatbot that talks to your data, and some talk of LLMs. But almost immediately the inevitable question comes: “Isn’t this just a prettier dashboard?”

The BI landscape is now saturated. Platforms like Tableau, Power BI, and ThoughtSpot have all added AI-driven features—from natural language querying to predictive analytics—but these are largely enhancements to visualization. Despite dozens of GenAI startups emerging recently, many are simply repackaging data with a prompt layer. The question remains: Where is the moat? And what truly distinguishes these offerings?

The reality is that while data is available in abundance, the ability to convert that data into timely, actionable decisions is still severely lacking.

Dashboards Didn’t Die—They Just Hit a Wall

For decades, business intelligence was about connecting data warehouses, cleaning pipelines, and building dashboards. In that model, displaying KPIs was the ultimate goal. Yet that approach has quietly broken down.

Even with billions spent on analytics tools, most enterprises still face delays in answering fundamental questions—like why performance dipped last week or which products are truly profitable. Research from McKinsey indicates that only about 20% of analytics efforts lead to actionable outcomes, underscoring a massive decision latency problem.

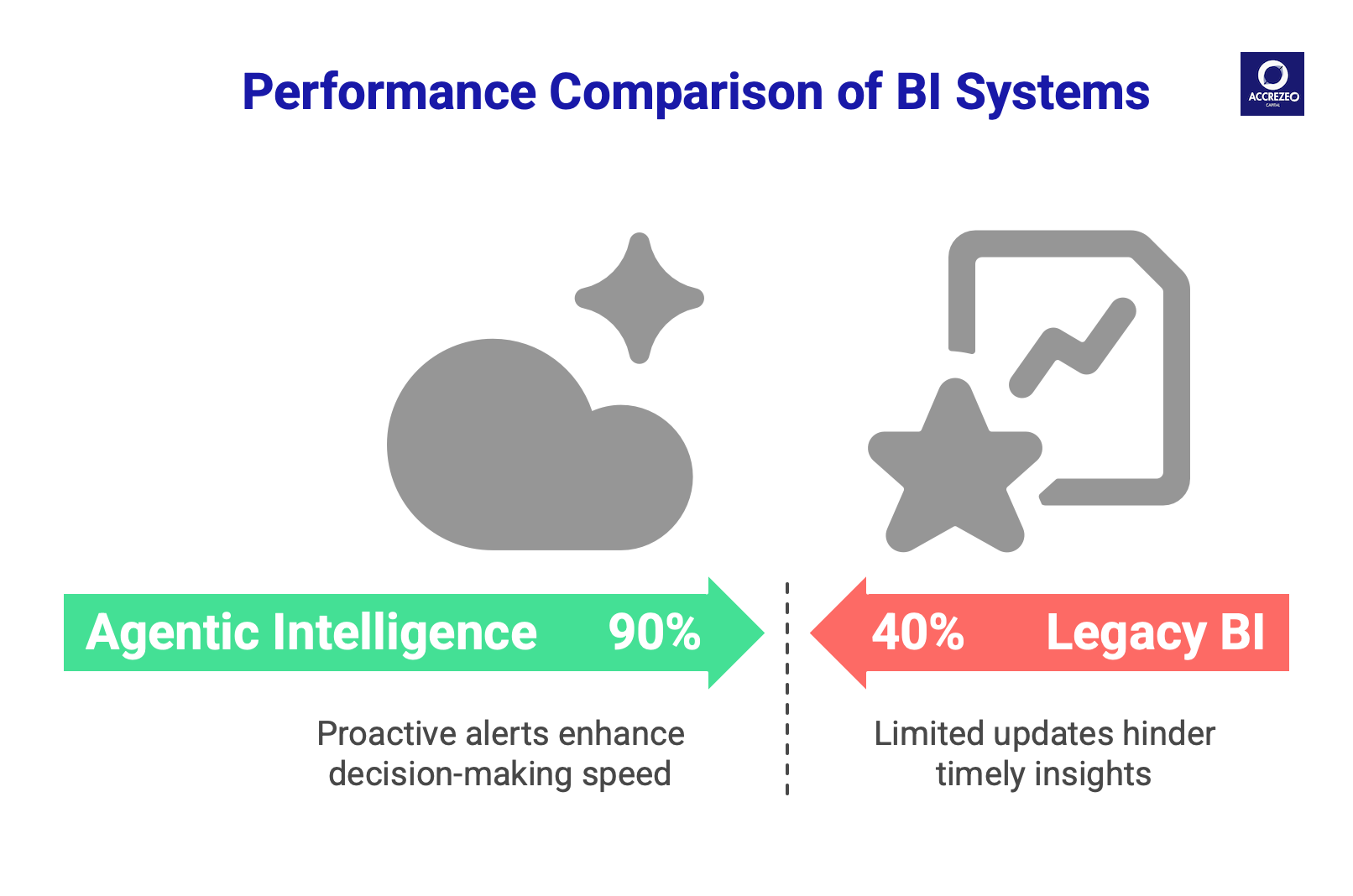

Traditional BI tools may display data, but they fail to close the gap between insight and action. The problem is not data availability—it’s that dashboards are simply too static to drive real-time decision-making.

The Shift to Agentic Intelligence

The next evolution in enterprise intelligence isn’t merely about faster or prettier dashboards—it’s about agency. Despite the rise of GenAI, most enterprise tools remain passive. They answer questions, generate summaries, and highlight trends, but they don’t take initiative. They don’t monitor, interpret, or act unless prompted by a user.

What enterprises truly need are systems that are intent-aware. These platforms must understand business goals, process context, and autonomously trigger workflows when necessary. This is the promise of agentic systems—platforms that function as persistent, goal-aware agents.

Snowflake’s Head of AI, Baris Gultekin, encapsulated this shift by stating, “The agent is the atomic unit of AI.” Snowflake’s Cortex Agents now operate as secure, modular components within enterprise environments, orchestrating tasks and adapting in real time. Deloitte’s concept of “dynamic decision engines” further underscores the emerging need for embedded, autonomous systems that drive outcomes instead of merely presenting data.

What Differentiated Platforms Actually Look Like

In the current market, many GenAI BI startups focus on enhancing the user interface—adding chat layers, generating summaries, and improving search functionality. While these improvements are visually appealing and can drive initial adoption, they rarely hold up in complex, real-world enterprise settings.

The truly differentiated platforms are those that re-engineer the decision-making process. They integrate seamlessly into existing ecosystems—plugging into systems like Salesforce, Power BI, and SAP—without forcing organizations to rip and replace their legacy systems. They bring value by extracting insights from fragmented data sources and then contextualizing that information to drive actionable decisions.

But Isn’t This Still Services-Led? Yes—and That’s the Point

It’s natural to worry that an early-stage enterprise intelligence platform might lean too heavily on services. Custom deployments, high-touch onboarding, and engineer-intensive integrations can make a company appear more like a consulting outfit than a scalable product business.

However, in complex enterprise environments, a services-heavy start is not a weakness—it’s a strategic on-ramp. Every large organization has unique data chaos. No two sales funnels are alike, and no two executives use dashboards the same way. To deliver true value, a platform must learn from each custom engagement, transforming those bespoke solutions into standardized, repeatable modules.

This is exactly the path taken by successful companies. Palantir, for example, deployed forward-deployed engineers to tailor solutions for each client, and that deep involvement ultimately formed the backbone of its scalable product. Similarly, ServiceNow’s early long-cycle implementations evolved into a partner-led model that drove its massive scale. In this context, early service work serves as the foundation for compounding IP and smarter agent logic—an evolution from high-touch customization to robust, product-led intelligence.

What Investors Should Actually Be Looking For

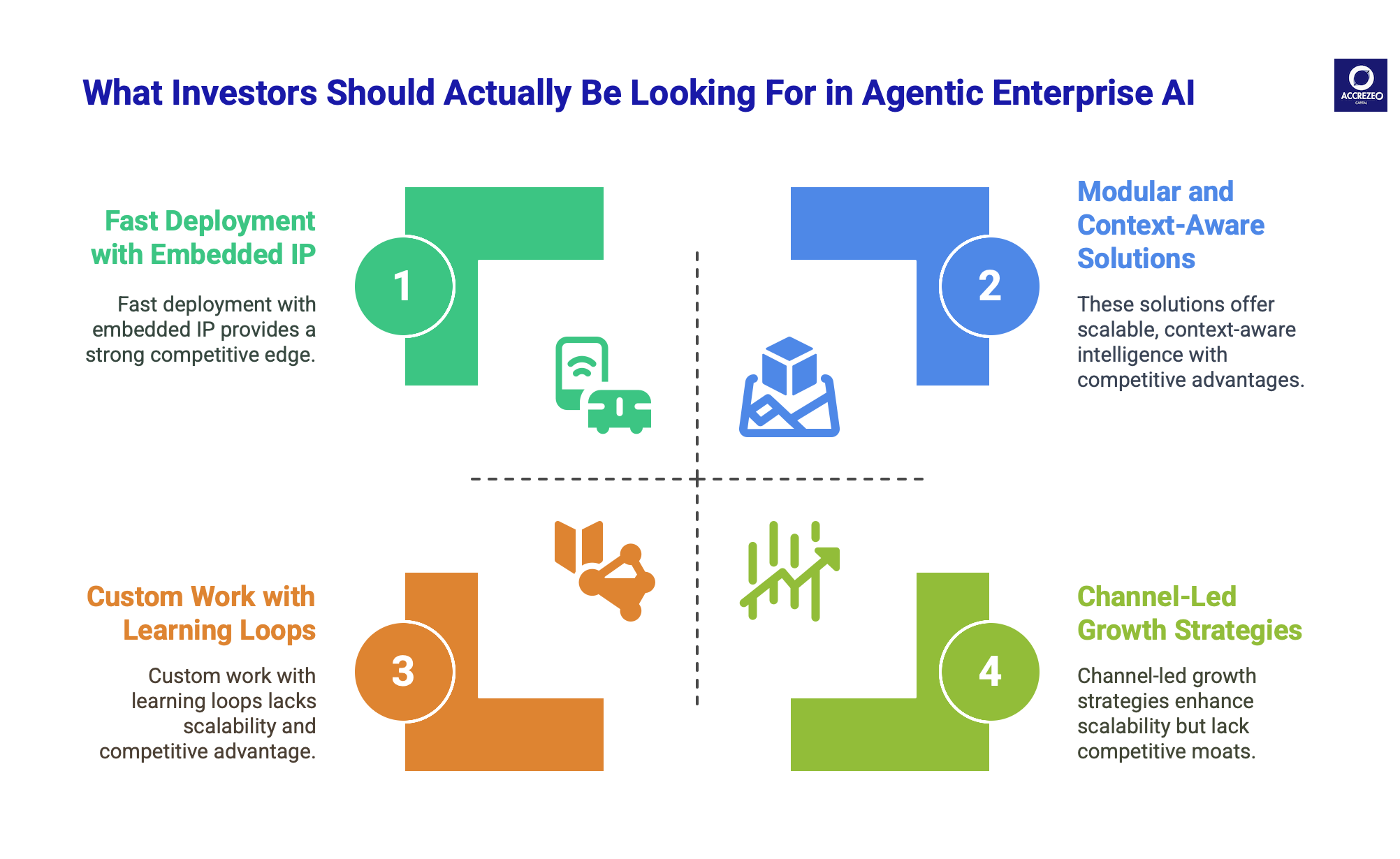

Investors must shift their focus from surface-level demos to underlying infrastructure and long-term scalability. The real differentiators in this space are not flashy interfaces or clever LLM integrations, but the depth of the platform’s architecture and its ability to evolve into a decision-making system.

Modularity over Custom Work:

The critical signal is whether early service engagements are translating into repeatable, verticalized modules. Reusable workflows indicate that the platform is moving from one-off projects to scalable solutions.

Deployment Speed as a Product Signal:

Time-to-value is a key indicator of maturity. If deployments shrink from months to weeks, it demonstrates that the system is not only learning but also standardizing its processes—an essential step toward broad enterprise adoption.

Intelligence Beyond Insight:

The platform must do more than display data. It should interpret context and recommend actions that drive outcomes. This transformation from an analytics assistant to an autonomous decision agent is what sets truly differentiated systems apart.

This is exactly the path taken by successful companies. Palantir, for example, deployed forward-deployed engineers to tailor solutions for each client, and that deep involvement ultimately formed the backbone of its scalable product. Similarly, ServiceNow’s early long-cycle implementations evolved into a partner-led model that drove its massive scale. In this context, early service work serves as the foundation for compounding IP and smarter agent logic—an evolution from high-touch customization to robust, product-led intelligence.

What Investors Should Actually Be Looking For

Investors must shift their focus from surface-level demos to underlying infrastructure and long-term scalability. The real differentiators in this space are not flashy interfaces or clever LLM integrations, but the depth of the platform’s architecture and its ability to evolve into a decision-making system.

Modularity over Custom Work:

The critical signal is whether early service engagements are translating into repeatable, verticalized modules. Reusable workflows indicate that the platform is moving from one-off projects to scalable solutions.

Deployment Speed as a Product Signal:

Time-to-value is a key indicator of maturity. If deployments shrink from months to weeks, it demonstrates that the system is not only learning but also standardizing its processes—an essential step toward broad enterprise adoption.

Intelligence Beyond Insight:

The platform must do more than display data. It should interpret context and recommend actions that drive outcomes. This transformation from an analytics assistant to an autonomous decision agent is what sets truly differentiated systems apart.

Channel-Led Growth:

Long-term scalability in enterprise markets depends on leveraging trusted ecosystem partners rather than relying solely on founder-led sales. Successful platforms grow through system integrators, advisory firms, and cloud marketplaces.

Embedded Intellectual Property:

While UI and prompt engineering can be mimicked, proprietary frameworks—such as domain-specific scoring models and knowledge graphs—form the true moat. Each deployment should enhance these embedded assets, making the system progressively smarter and more valuable.

Learning Loops as Infrastructure Proof:

The most important signal is compounding intelligence. If the system improves with every deployment—reducing rollout times and enhancing decision-making accuracy—it’s not just a tool; it’s evolving into an enduring infrastructure.

The Quiet Shift Already Underway

The transformation is unfolding quietly, not with fanfare or explosive headlines. Across industries, deep within channel partnerships and pilot deployments, the shift from passive dashboards to proactive decision engines is already taking shape.

Major platforms are reconfiguring their roadmaps. Snowflake’s recent introduction of Cortex Agents, Deloitte’s vision of dynamic decision engines, and McKinsey’s research on AI-enabled operating layers all point to a singular truth: enterprises are moving beyond mere data visualization toward systems that drive outcomes autonomously.

Most current tools remain stuck at the interface level—enhancing how data is viewed without fundamentally changing how decisions are made. Yet the true inflection point lies in architectures that embed intelligence within core workflows, reducing decision latency and compounding value over time.

If you found these insights useful, feel free to share them with your network — or anyone exploring enterprise AI, infrastructure, or product strategy.

You can also explore more of our research at accrezeo.com/blog, where we dive deeper into the shifts shaping next-gen enterprise platforms.Are you a founder building in this space? We’d love to hear from you — reach out via the contact form.If you’re an investor exploring this category, feel free to connect — we often collaborate on research and deal flow.