The Structure Hasn’t Changed, but the Market Has Not

The Indian haircare market remains vast and consistent — but structurally outdated. Even as consumer demand evolves, the category is still anchored in legacy formats, familiar brands, and an offline-first trade model.

Offline dominance hasn’t faded. Over 80% of haircare sales flow through general trade (GT) and pharmacy networks. While digital-first Ayurveda brands have emerged in recent years, most struggle to scale due to short shelf lives, high CACs, and limited distribution infrastructure.

What’s shifted is consumer intent. A growing segment of belief-driven, outcome-oriented buyers — especially in Tier 2–4 towns — is seeking efficacy-based Ayurvedic alternatives. But this group sits squarely in the ₹150–₹300 mass-masstige zone, a price band that remains underserved. Most premium brands don’t reach them; most legacy oils don’t convince them.

This is not a category without demand. It’s a category with a supply problem.

Why Most “Ayurveda” Brands Haven’t Scaled

Why Most “Ayurveda” Brands Haven’t Scaled

While Ayurveda has strong cultural pull, most new-age brands fail to scale beyond digital niches. The problem isn’t branding — it’s structure. Formulation methods, pricing, and channel strategy have all acted as growth bottlenecks.

The Boiled vs. Infused Formulation Tradeoff

Most Ayurvedic oils follow the boiled decoction method (Tel Pak Vidhi), where herbs are simmered in base oils. While traditional, this process often degrades active ingredients — resulting in low efficacy and visible outcomes.

In contrast, herb infusion techniques retain nutritional potency and deliver stronger results. But they’re costly and time-intensive, pushing prices into ₹500–₹700+ territory. This positions them out of reach for the ₹150–₹300 mass-masstige segment — the very group driving category volume.

D2C Isn’t a Scalable Funnel

Most Ayurvedic startups have focused on direct-to-consumer distribution. But high customer acquisition costs (CACs), limited retention, and short shelf life models make scale elusive. In Tier 2–4 cities — where Ayurveda belief is strong — offline access and trust matter more than Instagram storytelling.

A Mismatch Between Brand Positioning and Consumer Behavior

Premium brands lean heavily on urban wellness cues — personalization, clean labels, ritual-based usage — that appeal to early adopters. But mass-market belief-led consumers are ingredient-aware and outcome-focused. They seek visible efficacy at shelf, not just storytelling.

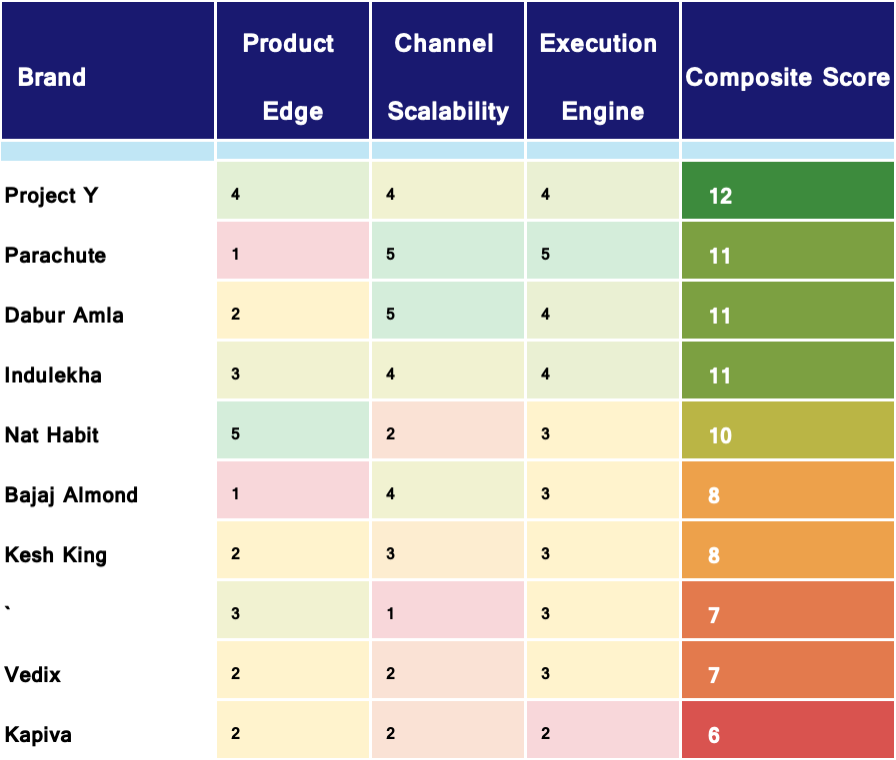

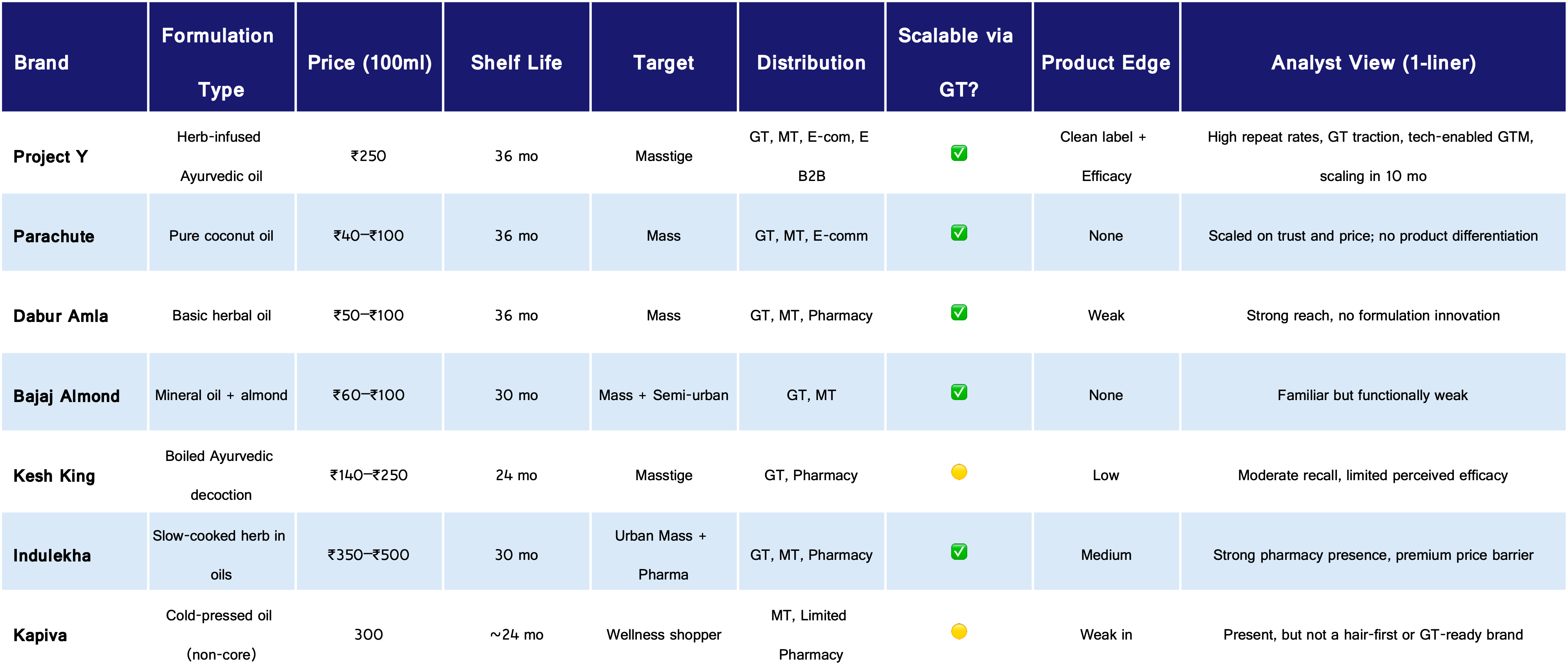

Execution Strength > Product Strength

For most brands in Indian haircare, scale hasn’t come from product innovation — it has come from execution. Brands like Parachute and Dabur Amla have retained market dominance not through efficacy claims, but through deep GT coverage, low onboarding friction, and trusted retailer relationships.

In contrast, newer brands with differentiated formulations — including Nat Habit and Traya — have struggled to break through. Price, shelf life, and channel misalignment continue to restrict their reach, regardless of perceived quality.

Offline-first distribution and trade-readiness remain more predictive of success than product differentiation alone. Sell-through at kirana shelves, repeat ordering from chemists, and GT margin structures are the levers that move the market — not social proof or digital traction.

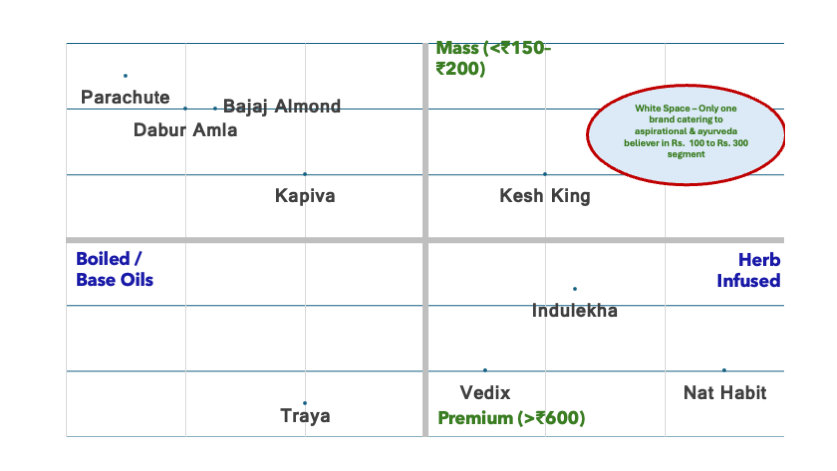

The Mid-Market Is Structurally Open

Most hair oil brands cluster at the extremes. Legacy products offer price and familiarity under ₹100, while premium D2C brands are priced ₹500+, driven by complex processes or wellness-first positioning. The ₹150–₹300 band — where scalable demand and margin viability intersect — remains structurally underserved.

Mainstream players haven’t upgraded their products to meet rising consumer expectations, while premium brands have priced themselves out of mass relevance. Even the few products with better formulation struggle to meet shelf life or GT-readiness thresholds required for scale.

This leaves the middle tier largely unoccupied — despite growing aspiration among Tier 2–3 consumers. Affordable efficacy with GT-aligned formats is the whitespace.

What Can Unlock It?

The mid-market consumer isn’t under-informed — just underserved. For this segment, product believability stems from a few clear levers: ingredient visibility, offline availability, and tangible outcomes at accessible price points.

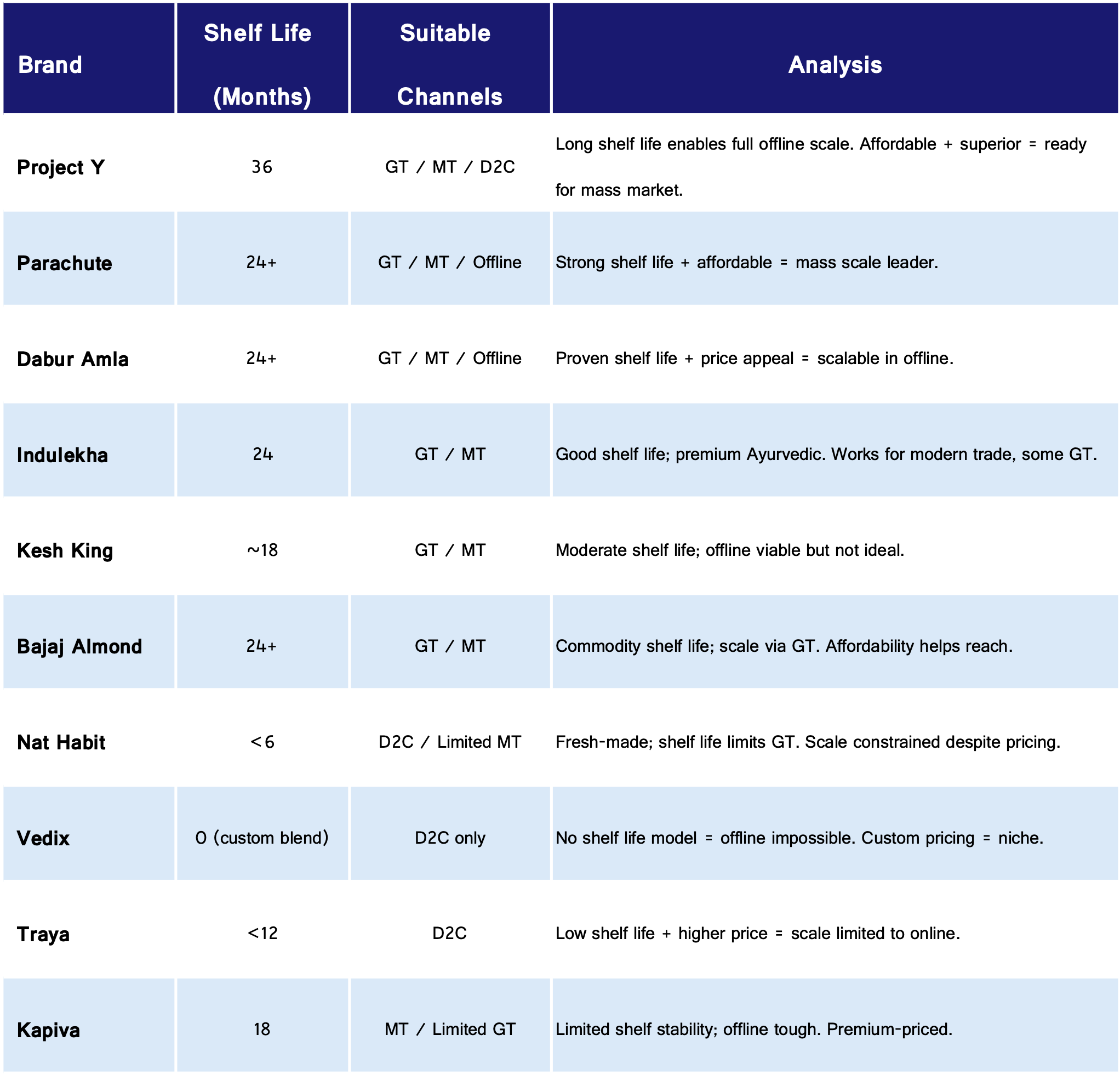

Scaling in this range requires trade-compatible execution. Formulation alone isn’t enough — brands need long shelf life, retail margins, and a clear reason to believe at the kirana shelf. Ayurvedic claims must be backed by familiarity and functional results, not marketing.

The gap lies in alignment: efficacy that meets shelf and price expectations, built into a format that works with — not against — general trade. Few brands have managed to solve across all vectors simultaneously.

What VCs Should Look For in Ayurveda

For investors evaluating the Ayurvedic haircare space, the question is no longer about consumer belief — it’s about structural scalability. The market has latent trust, visible demand, and purchase habits in place. But most brands have failed to convert this into sustainable business models.

Scalable plays tend to share five characteristics:

- Formulation That Performs — efficacy rooted in process, not just positioning.

- Mass-Compatible Pricing — ₹150–₹300 band with clear value visibility.

- Shelf Stability — 24+ month shelf life to unlock GT and pharmacy scale.

- Offline-Aligned GTM — kirana and chemist reach without channel mismatch.

- Retail-Ready Execution — trade margins, packaging familiarity, and sell-through velocity.

Investors should prioritize ventures that align structurally with the retail ecosystem rather than chasing premium D2C stories with limited headroom.

Closing Note: A Market Waiting to Be Built

The Indian hair oil category remains one of the few large, culturally embedded FMCG segments where consumer expectations have evolved faster than product innovation. Mass and masstige buyers increasingly seek efficacy, familiarity, and value — but few brands structurally deliver on all three.

This blog reflects our ongoing work in evaluating structurally scalable models in Ayurveda and mass personal care. We are currently supporting a startup in this space that is solving for formulation efficacy, shelf life, and offline distribution — the three levers that unlock GT-scale in India.

You can also explore more of our research at accrezeo.com/blog, where we dive into market shifts across consumer, enterprise, and consumer-tech categories.

Are you building in this space? Reach out.

Are you an investor tracking Ayurveda or FMCG? We often co-invest and share market insights — happy to connect.